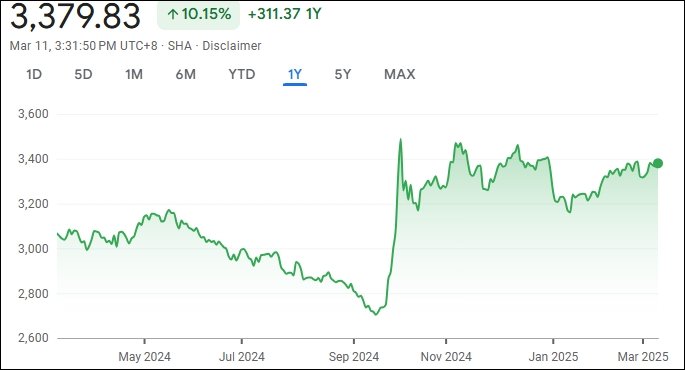

The Shanghai Composite Index (SHCOMP), a key indicator of the Chinese stock market, could be the turnaround story that global investors are waiting for. The big turn happened in September 2024 when the Chinese government unveiled key reforms in the real estate sector.

Then, China’s property market stability and economy were bolstered by coordinated efforts to address low confidence, falling prices, and liquidity issues affecting major developers. Since then SHCOMP has climbed 22% and is currently around 3,300. It had crashed to a low of 2,700 in September 2024.

Here’s a brief on the journey of the Shanghai Composite Index. Shanghai Composite Index was at an all-time high level of around 5,133 in January 2007, before the global financial crisis hit the financial markets. The next high was 4,381 which was reached in January 2015.

However, except for the bullish sentiment taking hold in September 2024, the sentiment had been tepid over a long time frame. Over the last three years, the index has been range-bound around 3,300. The index is down 4% over 3 years but is up by 10.15% over 1-year and nearly flat YTD.

Source: Google Finance

China holds big promise for investors as the stocks have remained range-bound for many years now. Recently, China also highlighted its robust policy toolkit to stimulate economic growth, emphasizing plans to advance technological innovation and boost domestic consumption, among other initiatives.

But the big question is whether FIIs are excited about China? And, are FIIs actually investing in China?

Chinese stocks could be depressed for various reasons, but on valuations they are looking attractive. The China-MSCI China Index PE Ratio is at 13 while India-MSCI India Index PE Ratio is at 22.

Nomura in its latest Asia-ex Japan Equity Strategy note retained its ‘Neutral’ stance on China and ‘structural Overweight’ on India stocks. The foreign brokerage said there is a scope of near-term outperformance of China over India, but it may not be long-lasting.

For China, it continues to believe that investors should be overweight China’s technology-related sectors, citing many incremental positives including the DeepSeek/AI narrative.

Nomura also cited US-China tensions, where the White House’s ‘America First Trade Policy’ and ‘America First Investment Policy’ designates China a key foreign adversary. Trump has already imposed an additional 20 per cent tariffs on Chinese imports.The country’s economic future remained clouded by a deepening trade war with the United States, with Beijing indicating its willingness to engage in ‘any type of war’ and dismissing the US’s fentanyl-related justification for slapping tariffs as a ‘flimsy excuse.’

Latest from China

The Ongoing Chinese National People’s Congress week-long meeting is expected to reveal much of the government’s efforts to shore up the dwindling economic conditions and provide cues for the market. Policymakers are prioritizing increasing consumer stimulus and economic support as top priorities.

The NPC is anticipated to aim for 5% GDP growth despite real estate and trade issues. Foreign policy, military spending, and technological developments will all be important subjects at the sessions, which will be widely watched across the world.

Will the Shanghai Composite Index once again react bullishly to these developments? Only time will tell…